Chemical firms feel Chinese import heat, knock Centre’s door for anti-dumping action

Domestic firms from the organic chemical and petrochemical sectors are making a beeline to the Government seeking anti-dumping probe against Chinese imports.

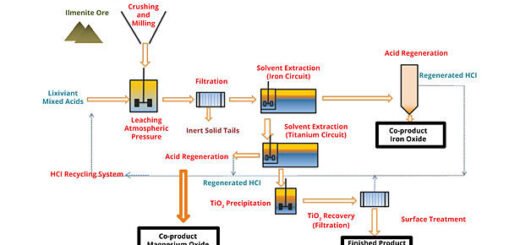

Over the last ten days, the Directorate General of Trade Remedies (DGTR) has initiated anti-dumping investigations or recommended anti-dumping duties against a dozen different Chemical, petrochemical and bulk drug products (mostly from China). These products are Sodium Cyanide, Flexible Skabstock Polyol, Titanium Dioxide, Azo Pigment, Effect Pigment (Countervailing Duty), Insoluble Sulphur and Plastic Processing Machines, sources said.

Anti-dumping

“I expect many more anti-dumping actions to happen on chemical products from China as it is a very challenging time for the industry. The last six months have been terrible and that is why you are seeing domestic industry approaching government on large numbers”, a chief executive of a chemical company said on condition of anonymity.

“The level of Imports from China vary from chemical to chemical. But across the board margins and volumes are affected for domestic firms”.

It was highlighted that India accounted for just 3 percent of global capacity, while China enjoys 50 percent.

“With China economy not doing well due to real estate slump, the chemical and material demand is down domestically. The domestic firms here are unable to even match the landed prices”, this top executive said.

One of the things the government must look to do is find a way to reduce the time taken for completing the anti-dumping investigation, it was suggested.

Chemical imports

India’s chemical imports from China has surged to around $ 15.5 billion in April -January 2024 from $ 11.3 billion in April-January 2020-21.

While Chemicals imports at dumped prices from China is matter of concern, the issue is not that worrisome for bulk drug imports from China.

Ankit Kansal, Chairman of PHDCCI’s Healthcare -Pharmaceutical Manufacturing Committee and Head of Special Projects, Mankind Pharma, said that domestic pharmaceutical firms have faced growing competition from Chinese imports in recent years, impacting pricing and market share. To address this, India has implemented measures like the production linked incentive scheme and plans for API manufacturing parks to boost domestic production, he said.

Unfair pricing

“The number of anti-dumping actions against China is increasing due to concerns about unfair pricing practices, market dominance, trade imbalances, regulatory compliance issues and allegations of unfair trade practices”, he said.

Kansal said that domestic API companies may face higher input costs this year due to rising raw material prices and supply chain disruptions. These challenges could impact their production costs and overall competitiveness in the market.

India’s imports of active pharmaceutical ingredients from China has risen from $ 2.17 billion in April-January 2021 to about $ 2.72 billion in April-January 2024.

API industry

API industry has faced challenges over the past four months, sources said. The rising costs of Key Starting Materials (KSMs) sourced from China have strained India’s API sector, with manufacturers unable to pass on these expenses to formulators.

This challenge is particularly evident in products heavily reliant on Chinese inputs.

“While China continues to support the pharmaceutical industry and supply predictability has improved, certain segments of the API industry face challenges due to China’s pricing strategies. However, these price hikes have not significantly impacted the formulation industry when compared to China’s overall market trends”, sources said.